Why Conventional Money Lenders Can’t Look Past the FICO Score

Traditional bank lending is based on personal history rather than potential. Because of this, your FICO score is the single most important metric for assessing your overall financial history. This creates a system that has a mandatory judgment toward you and your personal history, instead of looking at the profitability of your future investment.

This is because traditional banks have to follow stringent financial regulations put in place by the government, two of which are referred to as Frannie Mae and Freddie Mac. Frannie Mae is what many bankers call the Federal National Mortgage Association, and Freddie Mac is the Federal Home Loan Mortgage Corporation. These bureaus were created by Congress in 1938 and 1970 to help provide more liquidity and stability to the U.S. housing market. This allowed the banks to purchase loans to replenish their capital, so they could create more loans. These options required a dedicated system to approve and deny loan applications, including debt-to-income ratios and documentation, as well as minimum FICO thresholds.

What Is a FICO Credit Score?

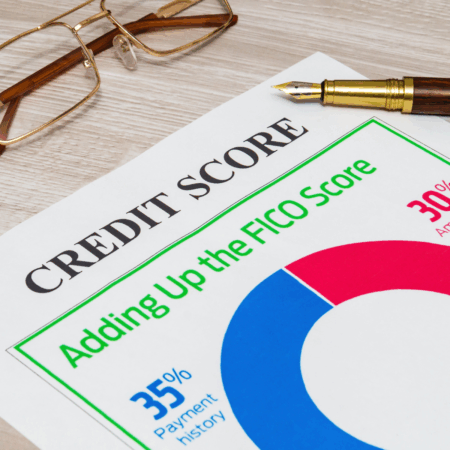

Some new borrowers might be wondering, “What even is a FICO credit score?”. A FICO credit score, at its core, is a digital snapshot of your credit history. Lenders most often use it to gauge your overall credit responsibility and financial portfolio. This figure can range from 300 to 850, and credit history details, such as borrowing and repaying debt from credit cards to mortgages and auto loans, determine it.

Why does the bank care about this when offering a traditional loan? Banks use your FICO credit score to see if they can trust you; they want to know if you have a stable history of fulfilling financial obligations on time. They use it as a risk analysis to gauge their trust in you and your upcoming project’s profitability. The primary things that can make your FICO score take a hit are shockingly common, including:

- Missing payments

- High credit utilization

- Collection accounts and public records

- Closing old accounts

- Too many hard inquiries on multiple lines of credit

- Defaulting on a loan

- Co-signing a delinquent loan

Because of these events, hard money loans can be an excellent alternative for fast turnaround lending options based on your project, not your personal history.

The Hard Money Mindset: Prioritizing the Collateral

What makes hard money lending different from traditional banking routes is that companies like Texas Funding shift the risk assessment from your personal credit history to the property’s future value and the overall plans you have in place. This makes our main goal assessing the actual project itself based on your exit strategy and development plans. Because the property itself is the collateral, instead of your own personal finances, the lender’s risk is mitigated much more fully than by simply looking at your FICO score.

Another key factor that separates hard money loans from typical, FICO score-based bank loans is the turnaround time. While bank loans are typically structured with significantly longer repayment terms and high interest rates, hard money loans are quite different. Most hard money loans in Texas are short-term loans, so lenders usually categorize them as having a repayment structure within 6-24 months. This is because most hard money loans are used in the real estate sector and have a repayment structure based on the project’s completion.

Instead of FICO scores, here are the three pillars of hard money loan confidence that lenders like Texas Funding opt for:

- After Repair Value: This is by far the most important index. It defines what the property will be worth after the project is complete – not what it is worth today. Hard money lenders consider this the margin of safety.

- Loan-To-Value Ratio: The hard money loan amount is determined by either the current or after-repair value, which creates the loan-to-value ratio. A lower ratio means less borrower risk, regardless of your credit score.

- Feasibility and Marketability: At Texas Funding, our lenders are constantly evaluating the local Houston market to ensure that the exit strategy you present is feasible based on current sales and demand.

Fast Lane to Profit: How Hard Money Opens Doors Banks Close

Houston’s real estate market is highly dynamic, which means that when it comes to securing top profitability, timing is everything. Because of this, hard money offers a true competitive edge compared to traditional bank loans when it comes to fast turnaround and time-sensitive deals.

The primary reasons for hard money’s undeniable edge are that our deals at Texas Funding close in days, not months. This is essential for auction, short-term, or highly competitive bids for in-demand projects. Some properties also might be highly attractive on paper, but have severe damage that keeps banks away, such as fire damage, no utilities, or non-conforming structures. When you have a vision for a full remodel, banks won’t be able to mitigate the risk, making hard money loans the only option.

Hard money lending gives you the flexibility you need to grab the perfect project in an instant, instead of waiting months or years for one single deal.

Bad Credit, Great Deal: How Hard Money Lending Compensates

The number one question on any lendee’s mind is always going to be “Is my credit good enough to apply?”. When it comes to hard money lending, that answer is yes. While many traditional banks have a hard, non-negotiable threshold when it comes to FICO scores, Texas Funding doesn’t view a low credit score as a complete dealbreaker. We seek to know the whole story, not just a single snapshot. Instead, we prioritize the strength of the property and project plan, your individual “skin in the game”, and simply ask if the deal makes sense.

When we offer hard money loans, the primary things we look at are a clear, spreadsheet-based plan with viable functionality. This needs to include the total price, plus the estimated gross profit of the completed project. Additionally, lenders need a well-documented report of all collateral for the project, including a detailed scope of what needs to be fixed and repaired. Lastly, we look at your character. We understand that people are more than just their credit history, and everyone deserves the chance to find success.

Hard money lending levels the playing field and helps provide real-world solutions for your lending needs. Contact Texas Funding today for a free hard money loan evaluation for your next project.